The topic of Opportunity Zones has been appearing everywhere lately. We recently attended the Urban Land Institute (ULI) of Colorado’s Opportunity Zones event to learn more and to educate ourselves. Six speakers shared their expertise on Opportunity Zones, including a State of Colorado Office of Economic Development and International Trade representative. Here are the highlights of what we learned.

What is an Opportunity Zone?

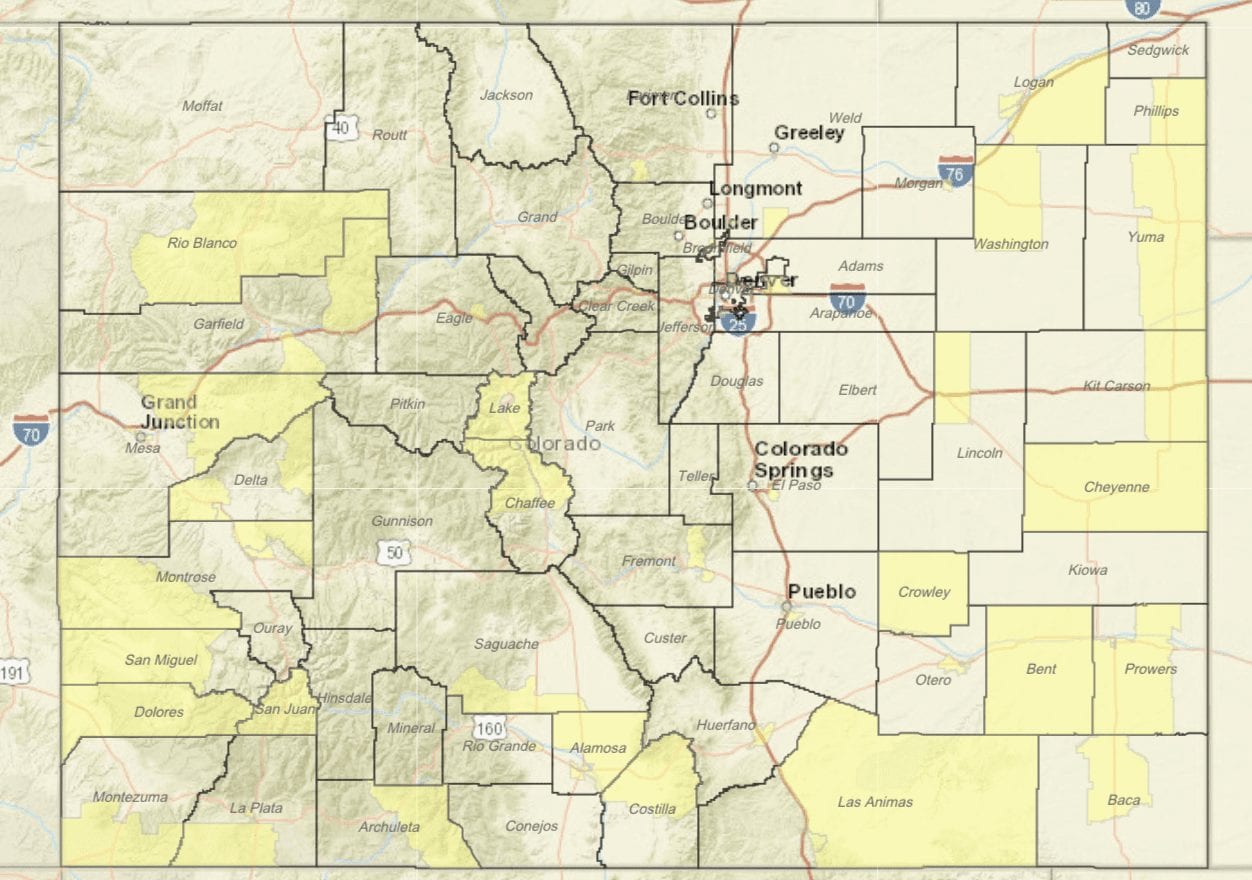

Opportunity Zones were recently introduced as part of the 2017 federal tax reform to spur economic growth in designated low-income communities by offering preferential tax treatment for new residential and commercial development investments. There are currently 126 Opportunity Zones across Colorado.

Photo Courtesy of Choose Colorado

Why Invest in an Opportunity Zone

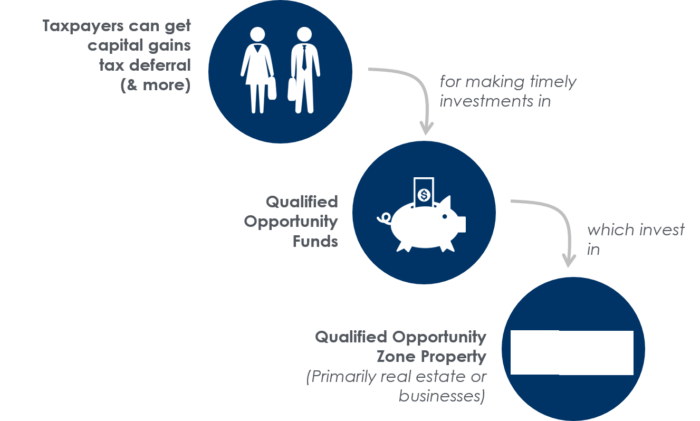

As an investor there are many benefits to investing in an Opportunity Zone:

- Deferring– Investors can defer their original tax bill with no up-front taxes on the rolled-over capital

- Reduction of tax– the rolled-over capital has a reduction in tax for long-term holding

- Tax-free appreciation– long-term holds for ten or more years, pay no capital gain taxes

Capitalizing on an Opportunity Zone gives investors who want to give back a new way of investing funds to improve the cities they love.

One of the speakers at the ULI event was Kurt Soukup with Bighorn Crossing, who spoke highly of this opportunity for multifamily development. Kurt said, “This is a great opportunity for multifamily, particularly when looking at an after-tax basis. Jurisdictions are on board for facilitating and are receptive and have a need for attainable housing. There is plenty of opportunity out there. Almost everyone has done a housing study. The capital is out there.”

Key Takeaways

- There is great potential to invigorate communities by providing more attainable homes.

- When considering investing in an Opportunity Zone, talk to a financial adviser to find out how this investment can benefit you and if it is worth taking on the risk.

- Investing early in an Opportunity Zone reaps the biggest benefits. If investors can hold their Opportunity Fund for five years prior to December 31, 2026, they can reduce their tax liability by 10%. If they can hold their Opportunity Fund for seven years prior to December 31, 2026, they can reduce their tax liability by 15%.

For more information on Opportunity Zones in Colorado, head to the Choose Colorado Website.

Opportunity Zone Map of Colorado Courtesy of Choose Colorado