In mid-July, experts from across the country joined Senior Housing News for a 3-day conference exploring the Active Adult residential market. Typically defined as housing in which a majority of residents are 55 years or older, this is the residential type that bridges between all ages, multi-family living and senior living. It has become a popular topic of discussion in real estate and investing.

A range of topics was discussed during the summit, from the ideal target residents and locations, to optimal building sizes, financial formulas and even what to call the market. Here are ten beneficial takeaways for developers looking to diversify their portfolios with this residential product type.

- The appeal of the Active Adult market for residents: The primary attraction is that these communities can legally cater to those 55 years or older. Other benefits include affordability, minimal maintenance, and opportunities for social connection. It offers a convenient “lock and leave” travel option, there is usually an emphasis on wellness, and there are a variety of lifestyle choices.

- The appeal of the Active Adult market for operators: If the community is designed and programmed with a variety of desirable amenities, operators can typically charge 25% more than a comparable multifamily community. Operational expenses are lower than traditional independent living. Since residents are often in charge of their own programs and recreation, operations run with fewer staff, resulting in greater profit margins.

- Resident Profile: The target demographic for Active Adult apartment communities is the Baby Boomer generation, made up of 73 million people. More than half of the residents in any given Active Adult community will come from within 10 miles of the building. The average age of residents moving into these communities for the first time is around 70 and nearly 2/3 of them are single women. Residents typically stay in their apartments between 5 and 7 years, which is a longer time frame than market-rate housing.

- Best Locations: The moderate climate of the U.S. south and west regions is attractive for people of all ages and has quickly made these areas the fastest growing for the Active Adult market in the country. Suburbs of metropolitan areas are also popular. Many older adults relocate to be closer to their children and grandchildren.

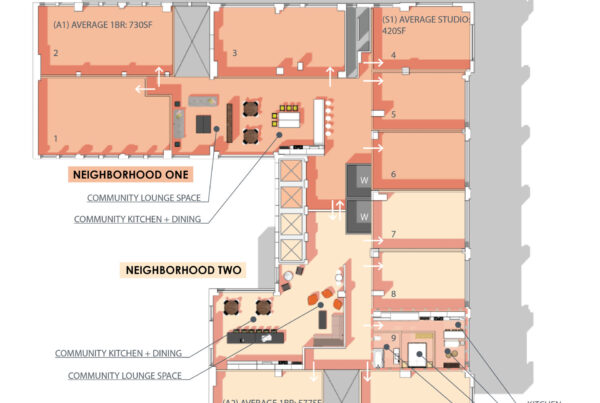

- Building Design and Programming: To achieve a strong sense of community and one that is not too large to manage, the optimal number of apartments is between 140 and 180, with about 65% 2-bedroom and 35% 1-bedroom. All units need to be large with lots of storage, as most residents will be downsizing from a home. Amenity areas should be comparable to market-rate buildings, ranging from 6,000 to 10,000 square feet. Buildings are typically 3 to 4 floors with one-level apartments. On average, there is one car per apartment. Technology is also an important factor as we become increasingly reliant on it, so include lots of telecom bandwidth

- Capital Markets: There is ample liquidity with debt capital markets. It’s financially attractive to balance sheet lenders (banks, debt funds), perm financing (Fannie Mae & Freddie Mac), and debt capital largely provided by multi-family lenders. There is an attractive return on investment, ranging from 7 to 8.5% yield. Cap rates are in line with Class “A” multi-family.

- Rent and Cost Control: Average rents range from $1,200 up to $3,500. There is an urgency to provide lower cost units to supply the huge Middle Market. There are some ways to lower costs: ‘value engineer’ the construction, include fewer amenities or a smaller clubhouse, consider acquisition to convert existing apartment buildings to Active Adult, and manage the building with less staff by offering fewer services.

- Management Costs Related to Staffing: In budget communities of around 150 units, there are usually only 4-5 employees: Property Manager, Leasing Manager, Facilities Manager, Property Technician, and sometimes a Lifestyle Coordinator. In upscale communities there are 7 or more employees, with the addition of move-in coordinators and an activities concierge. In terms of total operating costs, they typically are in the range of $7,000-8,000 per unit on an annual basis for a building of about 150-160 units.

- Challenges: Lease-up takes longer than for multi-family buildings, averaging 6 to 8 units per month with managers only closing 5-7% of their leasing traffic. Operators typically open buildings with at least 20% of the apartments leased. There are also emotional barriers to entering the Active Adult market. Residents are often downsizing for the first time ever, which can be a significant lifestyle change. There is general confusion about how to define this market. It’s not for 55-year old’s, even though it’s often called 55+ housing. As the residents in a community get older and less active, it no longer feels like an Active Adult community and becomes less attractive to prospective incoming residents. By its nature, it is exclusionary with a limited target audience – those people who do not want to live next to others of younger ages.

- COVID Impacts: While the Active Adult market is still very appealing from an investment and a resident point of view, until there is a vaccine, there will be some caution. The institutional capital markets have pulled back a little due to COVID. Home sales are the trigger to growth in the Active Adult Market. The pandemic has slowed the traffic for lease-up, causing operators to rely more on internet marketing. Design changes for new construction include more flexibility in the community common spaces, more balconies, touchless hardware, more instances of outdoor entrances to residents’ units, reduction in common hallways, more single-story buildings to avoid sharing elevators and stairs, and expanding the size of the main entry vestibules to create temperature check stations.

The Senior Housing News Active Adult “Summit” provided a basic road map for those companies interested in expanding into this residential project type. KEPHART has been designing these communities for many years, combining our expertise in the multi-family and the senior living markets. Along with our nation-wide reach, we are well positioned to be an expert design partner.